Insurance is essential for protecting homeowners. Buying residential real estate usually requires investing in standard homeowners insurance policies. The property is your responsibility, but it can be expensive when unexpected costs arise. Most people wonder does homeowners insurance cover structural damage?

Homeowners are estimated to spend roughly 1% of their home’s value each year on regular maintenance and repairs. Most homeowners insurance policies can cover some of these costs, including repairs to the house’s structure. Whether you will see your homeowners insurance cover costly repairs may depend on the insurance policy and the cause of the damage.

Purpose of Homeowners Insurance Policies

What does homeowners insurance cover? When you pay monthly premiums, the insurance company will reimburse or pay certain costs associated with covered losses. Generally, this includes damage from storms, fires, vandalism, hail, theft, lightning, falling objects, and water damage. When these situations cause damage to the home, you can file a claim to have the insurance company pay for the repair or replacement costs.

Will homeowners insurance cover structural damage? This often depends on the type of policy you have. Different policies have varying levels of coverage. Working with a reputable company is crucial to ensure your insurance covers structural damage, such as uneven floors, or other damage due to unexpected events, such as natural events.

Some policies specifically exclude coverage for things like poor workmanship or poor maintenance. These are deemed the homeowner’s responsibility. For example, policies may exclude structural issues due to faulty repairs, structural defects the owner knew about when purchasing the home, falling objects while working on the house, termites or other pests, or a burst pipe. Many of these structural issues are preventable.

Dwelling Coverage

Dwelling coverage protects the physical structure of the home, including the foundation, walls, and roof. This type of coverage is included in most standard policies. Whether your homeowners insurance covers structural damage often depends on the underlying cause.

Other Structures Coverage

Your insurance company may also cover other types of structural damage. For example, if there is a detached garage or shed on your property, insurance may reimburse you for structural issues after a covered peril. For example, if there are foundation issues due to flood damage.

Perils Covered

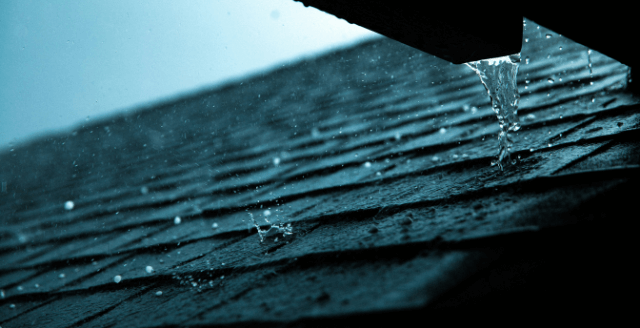

A homeowners insurance policy has specific conditions that must be met for a valid claim for your home’s structure. A covered peril must cause the structural damage in question to be eligible for compensation. Common perils in the claims process include storms, fires, water damage, theft, vandalism, wind storms, hail storms, and falling objects.

You can purchase additional coverage to insure other losses. Natural disasters and floods are not typically included in homeowners insurance, so you may have to pay for separate flood insurance for extra protection. Insurance companies may require add-on coverage or a separate policy for things like tornadoes, theft, or hail.

Structural Repairs and Homeowners Insurance

Structural damage is one of the most common reasons for filing a homeowners insurance claim. Whether you are facing damage to the walls, roof, framing, or foundation, the insurance company may cover major problems depending on what caused them. They may also cover repairs to prevent further damage.

Covered vs. Non-Covered Structural Damage

Your home insurance will only apply if a covered peril causes structural damage. A bad rain storm could cause water to leak into the foundation and compromise the materials, forcing you to pay for repairs. A fire could break out and damage some of the walls and framing in your home, requiring replacements.

Structural damage not covered by these listed perils must be paid out of pocket. Normal wear and tear is typically not covered by home insurance.

Common Exclusions

The typical homeowners insurance policy does not cover all circumstances. Damage from earthquakes, floods, and normal wear and tear may be ineligible for compensation unless you have purchased additional insurance packages. This often varies depending on your location and common natural disasters in your area.

Determining Coverage

When you file a claim, the home insurance company will assign an adjuster to investigate it. This individual will assess the damage based on your documentation and a physical inspection. They will decide if you are eligible for compensation for the necessary repair costs. This is why providing documentation of the structural damage, such as photos and videos, is essential for your claim.

Factors Affecting Coverage

The amount of coverage you receive through homeowners insurance depends on numerous factors. Here are some considerations the public adjuster will make to decide how much compensation you’ll receive for the repair or replacement costs.

Cause of Damage

First, the adjuster will determine if the cause of the damage was a covered peril. The more evidence you can provide to the insurance company of the cause, the more likely your claim is to be approved. It’s crucial to document evidence as soon as the damage occurs or as soon as you notice foundation damage.

Policy Limits and Deductibles

Your policy has a limit to cover structural damage costs. Typically, the insurance carrier will not pay out more than this limit, no matter the true extent of the damage. If you have major structural issues, you may need more than the coverage limit for the total repair costs.

You should also be prepared to pay a deductible, a set amount of money paid out of pocket, before the insurance kicks in to pay the rest. The deductible you pay often varies depending on yrou insurance policy. Generally, policies with a higher deductible offer higher coverage for things like foundation damage.

Age and Condition of the Home

Older homes face increased risks due to aging structures and outdated building codes. Insuring an old or poor-condition home could cost more money, so the policy limits may be adjusted for an aging or rundown home, resulting in lower payouts.

Filing a Claim for Structural Repairs

If you have experienced structural damage to the home, you must know how to file a claim correctly. Here are some tips to increase your chances of receiving sufficient coverage for things like foundation damage.

Reporting the Damage

You must report structural damage to the insurance company as soon as possible. Most carriers have deadlines for filing claims after a covered loss, so report the structural damage as quickly as possible.

Documentation and Evidence

Evidence is the key to securing compensation to cover structural damage costs. Take pictures and videos of the full extent of the damage to include with your claim. Acquire estimates for repair costs from qualified contractors. The more information you provide, the easier it will be for the adjuster to approve your claim.

Working with the Insurance Adjuster

The insurance adjuster is responsible for investigating your claim and determining coverage for structural problems. Communicate openly and honestly with them to facilitate a smooth process. You can also ask them questions like “Will homeowners insurance cover structural damage?”.

Benefits of Hiring a Home Restoration Company

If your home has suffered structural damage that costs a lot of money, working with a professional restoration company can help with your claim and the repair process. This company can tackle the reconstruction process by providing expertise, efficiency, quality work, and specialized equipment and help you acquire accurate estimates for the insurance claim.

Call Us Today!

When you have questions about professional repairs for the home’s foundation or providing documentation for a homeowners insurance claim, PacWest Restoration can help. Our team can provide quality roof, wall, framing, and foundation repairs to return your home to its pre-loss condition. We also can provide accurate estimates to help you file your insurance claim.

Call us today at 503-746-65455 or complete the online form to request a free assessment for structural damage. We’re here whenever you need professional assistance regarding foundation damage, preventing structural damage, maintenance, or cleaning up after a storm.